- WCASD

- Homepage

West Chester Area School District School Board Approves Preliminary Budget for 2024-25 School Year

The West Chester Area School District (WCASD) School Board of Directors approved a preliminary budget for the 2024-25 school year of $322,344,067, which includes a planned $5 million contribution of fund balance to the capital fund to offset costs associated with the elementary school renovation plan. The preliminary operating budget, excluding the $5.0 million transfer to capital funds represents a $15 million increase over the current budget (4.98 percent). The largest component of the budget is the salaries and benefits for the district’s 1,580 employees, which rose $8.4 million (5.4 percent). The 2024-25 budget includes the addition of $1.9 million in staffing costs.

“The district’s preliminary budget prioritizes investing in our exceptional staff who are dedicated to supporting all students' growth and achievement. While addressing rising costs, we're strategically adding teaching roles and specialists to personalize instruction, meet diverse learning needs, and uphold our reputation for high-quality education,” said WCASD Superintendent, Dr. David Christopher.

The increases in staffing costs are partially offset by reductions in services which were previously outsourced as contracted services. Other increases include more than $4 million directly related to the following state and federal mandates:

- $2.5 million increase in state-mandated pension expenses, a 6.1 percent increase over the current year's budget.

- $689,000 in Contracted Special Education Services

- $830,000 in transportation expense, a 4.6 percent increase over the current year.

“As a board, our goal is to balance the educational needs of our students and staff with the interests of our community members. This budget aims to make prudent, cost-effective decisions,” said School Board President, Karen Fleming.

“The board and district administration have worked diligently to keep any increases as low as possible. We believe the key areas outlined in this budget will allow for highly engaged learners and a strong community,” added Fleming.

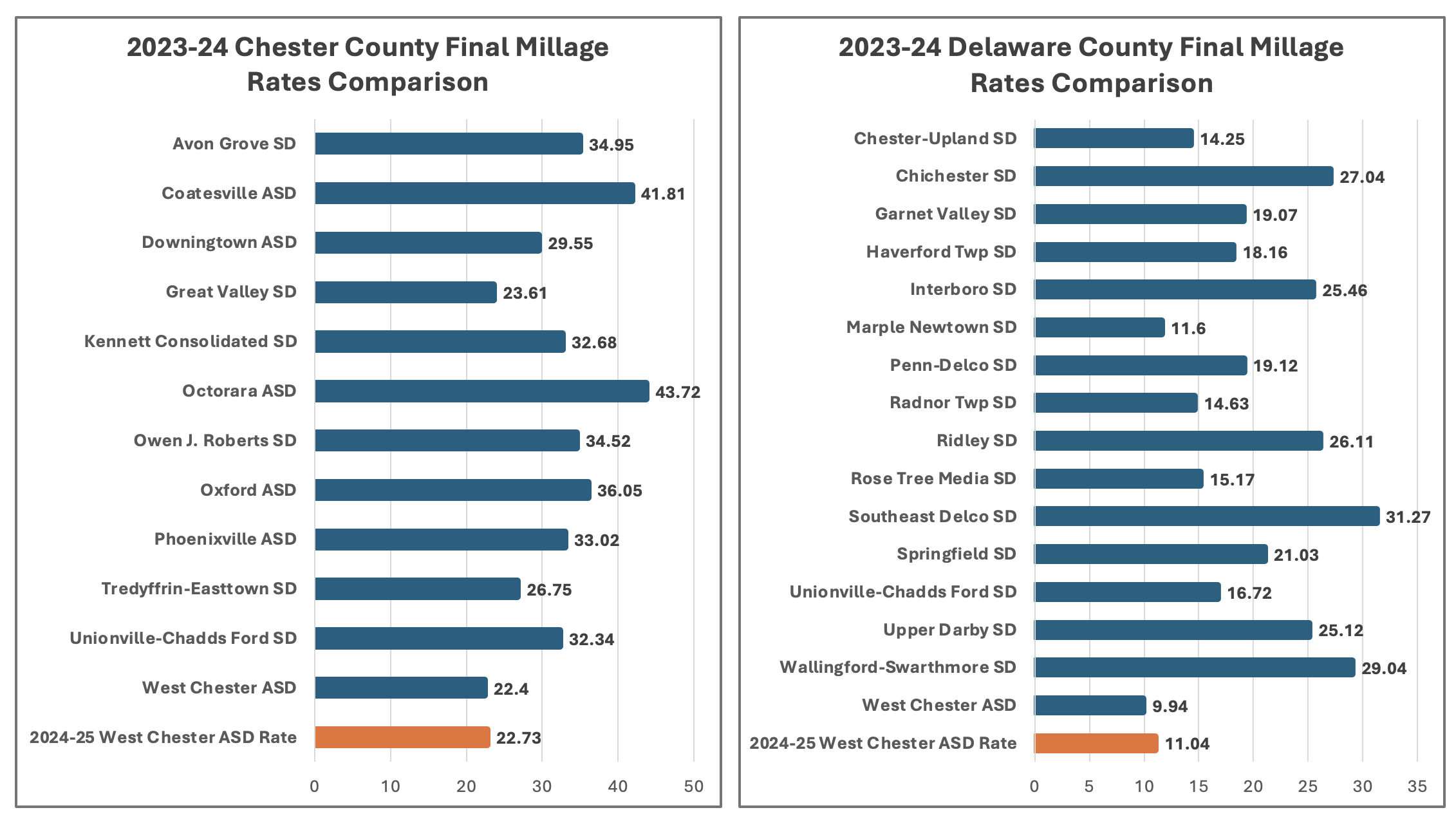

The district balanced the 2024-25 budget with a 1.3 percent tax increase to Chester County property owners and an 11.1 percent increase for Delaware County property owners. The variance in tax increases between counties is due to the change in market values that the PA State Equalization Board (STEB) reported to WCASD. Based on the latest STEB valuations, which the district is required to use as the basis for taxation, Chester County saw an increase in market value of 9.4 percent while Delaware County saw an increase in market value of 17.5 percent over the previous year. This change in market value shifts a larger portion of the tax burden to the residents of Delaware County. The preliminary property tax millage rates for West Chester remains the lowest in both Chester County and Delaware County. The district utilized savings from the 2023-24 operations to help offset the need for millage increases for the 2024-25 budget. The district’s undesignated fund balance is approximately $20.2 million.

“One aspect of the preliminary budget that warrants further explanation is the tax increase for residents in the Delaware County portion of our district,” said school board member and chair of the Property & Finance Committee, Mr. Gary Bevilacqua. “This difference does not stem from the district treating the two counties differently. Rather, it stems directly from the latest market value of properties provided by the state.”

Bevilacqua noted that the state’s market value process indicates Delaware County’s overall increase in market value being significantly higher than Chester County, sharing, “Since our school taxes must be equitably distributed based on these market valuations, the higher property values in Delaware County translate to a larger tax burden being shifted to those residents. We recognize the impact of this change, and we remain committed to fiscal responsibility and transparency.”

2024-25 District Tax Rates

Based on the preliminary budget, the real estate tax rate for Chester County will be 22.73, a 1.3 percent increase, the Delaware County tax rate be 11.04, an increase of 11.1 percent over 2023-24. The average assessed home value in Chester County is now $189,850, which is approximately 40 percent of the home's market value. The average assessed home value in the Delaware County portion of the district is $502,336, which represents 90 percent of the market value. At the preliminary rate, Chester County residents will see a $57.00 increase in their taxes and Delaware County residents will see an average increase of $553.00.